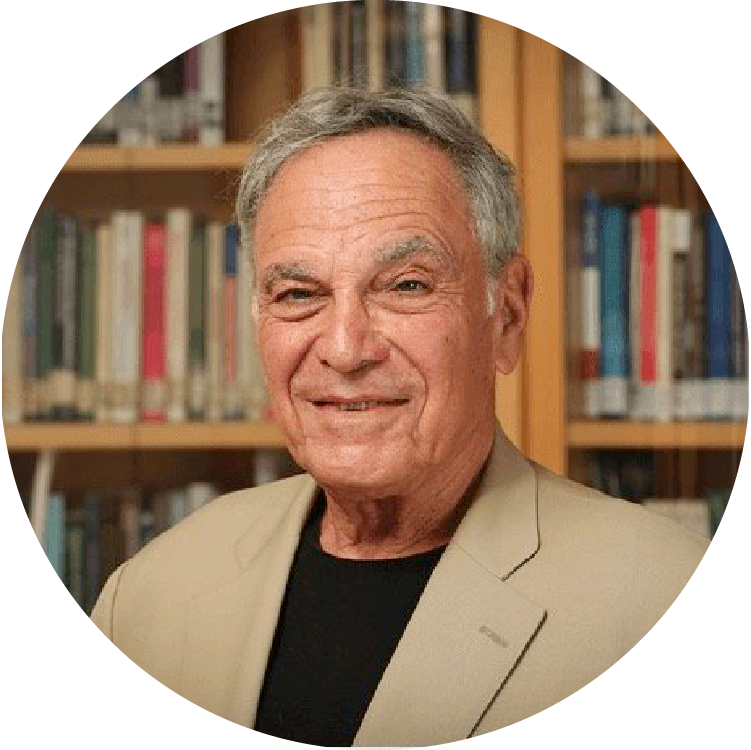

Eytan Sheshinski

Bio

Eytan Sheshinski is the Sir Isaac Wolfson Professor of Public Finance Emeritus at the Hebrew University of Jerusalem.

Sheshinski received a B.A. in economics and M.A. in economics and statistics from Hebrew University and a Ph.D in economics from the Massachusetts Institute of Technology.

His recent research has focused on the taxation of non-renewable resources, social insurance and markets for annuities, behavioral public economics and the social implications of bounded rationality.

Sheshinski has been a Visiting Professor at Princeton, Harvard, Stanford, Columbia, California (Berkley), MIT,Brown and other Universities. He served on editorial boards of leading economic journals.

Sheshinski is a member of the American Academy, the Royal Swedish Academy and a Fellow of the Econometric Society. He received number of prizes and has a doctor Honoris-Causa from the Stockholm School of Economics.

Sheshinski was engaged extensively in economic policy in Israel. In 2010, after the discovery of large offshore gas deposits, he headed a committee on the taxation of the private franchisees of these deposits and in 2014 he headed another committee on the taxation of all other natural resources (mainly chemicals from the Dead sea).The recommendations of both committees were adopted by the Knesset and became laws (‘Sheshinski 1’ and ‘Sheshinski 2’).

In the 1980’s Sheshinski was asked by the government to recommended methods to accelerate the sale of state owned enterprises in Israel by floating shares in stock markets.

Sheshinski served as Chairman of the Board of directors of Koor Industries and on the board of directors of Psagot Investment House.