Introduction

Student debt now surpasses $1.5 trillion, and over 7 million borrowers are in default.1http://studentaid.ed.gov/sites/default/files/fsawg/datacenter/library/PortfoliobyLoanStatus.xls. Other data can be found at https://studentaid.ed.gov/sa/about/data-center/student/portfolio So it is little wonder that many people are concerned that access to higher education is becoming out of reach or, even worse, that the United States might be approaching a student debt crisis akin to the financial crisis of 2007–09. In addition, a growing body of evidence documents substantial negative effects of student debt, ranging from reduced access to other forms of credit, lower homeownership rates, delays in marriage and family formation, and less entrepreneurship.2See Hedlund, Aaron, “The Race between Debt and Opportunity: A Primer on the Past, Present, and Future of Higher Education,” CGO Policy Paper 2019.007. These worries have led to the emergence of numerous proposals aimed at tackling the growing burden of student debt. However, there are many misconceptions about student debt and the factors driving default.

This paper discusses patterns regarding student debt and, after a careful assessment of the data, concludes that broad-based loan forgiveness would be an expensive and poorly targeted solution to debt woes. Instead, automatic income-contingent repayment coupled with dropout insurance are more promising and cost-effective avenues to reduce the burden of student debt.

Setting the Record Straight: Facts about Student Debt and Default

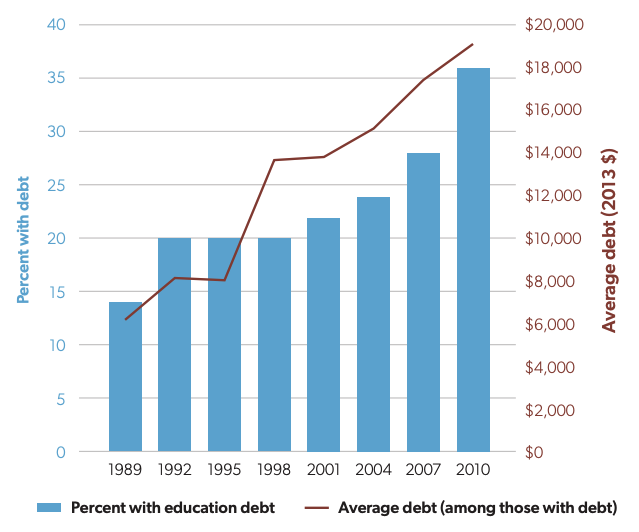

Student debt has experienced nearly unabated growth over the past few decades, with the fraction of students taking out loans more than doubling since 1989 and the average debt per borrower tripling, as indicated in figure 1. Admittedly, this larger debt has been accompanied by a higher college wage premium, with college graduates now earning on average twice as high of a wage as those with only high school diplomas.3See Figure 8 in Hedlund (2019). But the continued prevalence of student loan default indicates that, for some borrowers, the income benefits from college attendance have not been large or fast enough to allow for successful loan repayment. However, despite the anecdotes about borrowers wrestling with six-figure loan balances, the data paint a different portrait of the student debt challenge facing the United States.

Figure 1: Student Loan Patterns Over Time.

Source: Lochner and Monge-Naranjo (2016)4See figure 3 of Lochner, Lance and Alexander Monge-Naranjo, “Student Loans and Repayment: Theory, Evidence, and Policy,” 2016, Handbook of the Economics of Education, Volume 5, pp. 398–478.

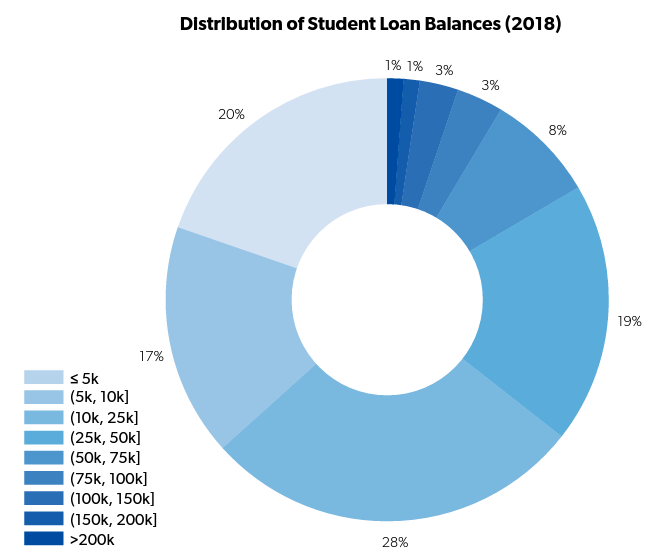

The typical borrower owes less than $25,000, but there is a wide range. The typical borrower has a cumulative balance of less than $25,000 today, and that is significantly higher than the average borrower in the past. However, that measure alone does a poor job of representing the overall student debt situation.5Based on data from the New York Fed Consumer Credit Panel. For more information, see https://www.newyorkfed.org/microeconomics/databank.html.First, this average includes both those burdened by large amounts of debt and the approximately one-third of students who graduate without any debt at all.6For the share who graduate without any debt, see figure 5 of Lochner and Monge-Naranjo (2016).Second, that $25,000 amount pales in comparison to the lifetime value of a college degree, which can amount to hundreds of thousands of dollars.7See Avery, Christopher and Sarah Turner, “Student Loans: Do College Students Borrow Too Much—Or Not Enough?” 2012, Journal of Economic Perspectives, Vol. 26(1), pp. 165–192.

Delving deeper into the distribution of debt, figure 2 reveals that 20% of borrowers have less than $5,000 in cumulative student loans, and 37% owe less than $10,000. The threshold debt amount that researchers use for defining “large balances” is $50,000, but only 16% of borrowers fall into this category. Moreover, most large-balance borrowers possess or are in pursuit of graduate degrees and can therefore expect even higher earnings over their lifetime.8See table 2 of Looney, Adam and Constantine Yannelis, “Borrowers with Large Balances: Rising Student Debt and Falling Repayment Rates,” 2018, Economic Studies at Brookings, The Brookings Institution. By contrast, only 10% of borrowers with terminal bachelor’s degrees have large balances.9This number is from 2012 and can be found in figure 1 of Baum, Sandy and Martha Johnson, “Student Debt: Who Borrows Most? What Lies Ahead?” 2015, Urban Institute. For more information, see figure 4 of Baum and Johnson (2015).

Figure 2: Student Debt Distribution.

Data Source: New York Fed Consumer Credit Panel

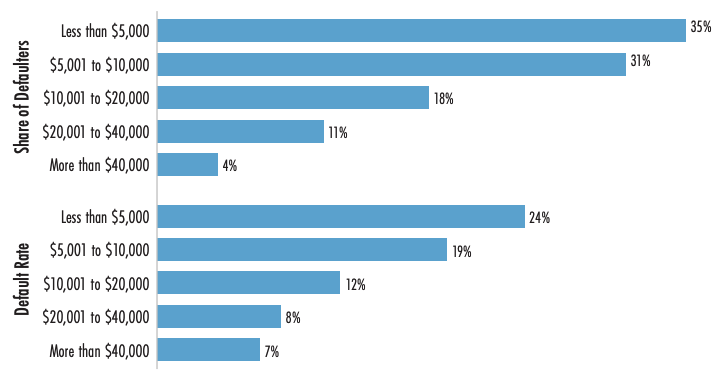

Most defaulters have small balances. Many dropped out. Despite all the attention received by borrowers with large balances, nearly two-thirds of defaulters have less than $10,000 in student debt. In fact, figure 3 shows that the default rate for borrowers with less than $5,000 in debt is more than three times that of borrowers with over $40,000 in debt. While it is true that, all things equal, higher debt increases the probability of default, the data indicates that borrowers with larger balances tend to have higher incomes—not because debt causes higher income, but because large-balance borrowers are more likely to have advanced degrees (e.g., medical or law degrees) that earn higher incomes. By contrast, only 15% of borrowers with less than $10,000 in student debt finish their bachelor’s degree.10See table 1 of Baum and Johnson (2015). Unsurprisingly, dropouts are much more likely to default (24%) than graduates (9%), who have a larger amount of debt but are more than compensated by higher incomes.11https://trends.collegeboard.org/student-aid/figures-tables/two-yearstudent-loan-default-rates-degree-completion-status-over-time.

Figure 3: Default Rate by Loan Balance.

Source: College Board12https://trends.collegeboard.org/student-aid/figures-tables/share-defaultersand-three-year-default-rates-loan-balance.

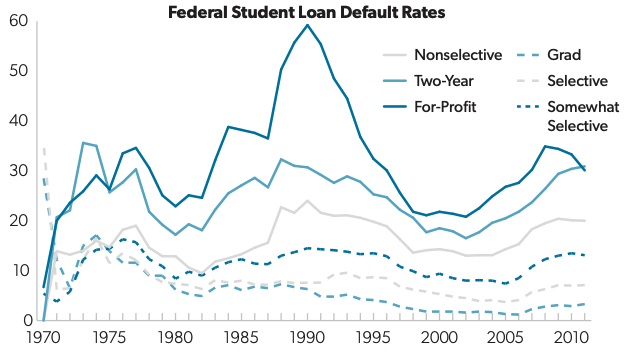

Default rates are disproportionately high at two-year and for-profit schools. Student loan default rates began rising in the mid-2000s, as shown in figure 4. However, they have since leveled off and are still well below their 1980s peak when the student loan bankruptcy regime was laxer.13In response to high default rates in the 1980s, legislators gradually made student debt nondischargeable, essentially switching them from a Chapter 7 liquidation in the Bankruptcy Code to a Chapter 13 debt reorganization. For more details, see page 154 of Ionescu, Felicia, “Risky Human Capital and Alternative Bankruptcy Regimes for Student Loans,” Journal of Human Capital, Vol. 5(2), pp. 153–205.Moreover, a disproportionate share of the mid-2000s rise in the student loan default rate occurred at two-year and for-profit schools, with the three-year default rate at for-profit schools exceeding that of selective institutions by a factor of four.14Looney and Yannelis (2015) define a selective institution as one which admits fewer than 75% of applicants.

To gain insight into the difference in default behavior across institution types, note that selective schools have a four-year completion rate of 83%, whereas two-year colleges have less than a 40% completion rate, and for-profit schools fare even worse at a 28% completion rate.15See figure 4 of Looney and Yannelis (2015). Students from two-year and for-profit institutions are also more likely to be unemployed after they leave college.16See figure 5 of Looney and Yannelis (2015). Furthermore, for-profit schools account for a disproportionate share (24%) of large-balance bachelor’s degree recipients relative to their overall share (9%) of graduates.17See figure 5 of Baum and Johnson (2015). However, before jumping to any conclusions about the quality or practices of two-year and for-profit schools, it is important to note that they disproportionately enroll nontraditional students who are more likely to be older, part-time, and lacking in financial support from their parents.18Deming, David J., Claudia Goldin, and Lawrence F. Katz, “The For-Profit Postsecondary School Sector: Nimble Critters or Agile Predators?” 2012, Journal of Economic Perspectives, 26(1), pp. 139 – 164.

These findings demonstrate that high dropout rates and poor post-college job prospects play an outsized role in student loan default. However, the importance of bad labor market outcomes in explaining default does not imply that all borrowers who enter delinquency are fundamentally incapable of paying. To the contrary, one recent study has found that some borrowers default strategically—that is, they could pay but choose not to—and that the default rate would increase by 50% if wage garnishment were eliminated.19Yannelis, Constantine, “Strategic Default on Student Loans,” 2016, Working Paper.

Figure 4: Student Loan Default Rates.

Data Source: Looney and Yannelis (2015)20 Looney, Adam and Constantine Yannelis, “A Crisis in Student Loans? How Changes in the Characteristics of Borrowers and in the Institutions They Attended Contributed to Rising Loan Defaults,” Fall 2015, Brookings Papers on Economic Activity.

Is Loan Forgiveness the Answer?

Almost inevitably, any broad-based loan forgiveness program would disproportionately favor higher income households, because they tend to have the most debt. Keep in mind that they are also more likely than others to repay those debts. Overall, student loan default rates are driven disproportionately by people with modest amounts of debt but poor employment opportunities. So spending hundreds of billions of dollars or more on loan forgiveness that would include people who are perfectly capable of timely repayment is neither the most cost-effective nor targeted away to alleviate financial distress.

Another complication is that blanket student loan forgiveness would only deal with current outstanding student debt without resolving the thornier issue of how to prevent the same problems from re-emerging. Such an intervention could even have the counterproductive effect of encouraging more debt accumulation in the future if borrowers anticipate their loans may be forgiven.

Alternative Student Debt Reforms

The evidence provided earlier in this paper has prompted economist Susan Dynarski to conclude that “we do not have a debt crisis but rather a repayment crisis. The current system turns reasonable levels of debt into crippling payment burdens that can prevent young workers from attaining financial independence and stability.”21Dynarski, Susan and Daniel Kreisman, “Loans for Educational Opportunity: Making Borrowing Work for Today’s Students,” Discussion Paper 2013-05, The Brookings Institution, page 4. Currently, student loans are similar to mortgage debt in that they feature a rigid schedule of fixed payments regardless of a borrower’s income. Borrowers do have some options to delay or adjust repayment—such as deferment and forbearance, which together account for $258 billion in nonrepayment compared to $148 billion for default. Existing programs, however, provide inadequate insurance and leave taxpayers exposed to losses.22 http://studentaid.ed.gov/sites/default/files/fsawg/datacenter/library/PortfoliobyLoanStatus.xls.

In the short term, the U.S. could benefit from changing its student loan system in two ways: (1) make repayment contingent on income and (2) provide insurance against dropout risk. In the long run, finding ways to reduce college tuition and improve graduation rates would likely pay even larger dividends.

Automatic income-contingent repayment

The most natural way to minimize financial distress from student debt is to more closely align the timing of loan repayment with periods of higher income, while providing relief during periods of unemployment or low income. In fact, the U.S. already has multiple income-based repayment programs that attempt to do just this, though only 29% of borrowers are enrolled in such a plan as of 2018.23https://trends.collegeboard.org/student-aid/figures-tables/distributionoutstanding-federal-direct-loan-dollars-and-recipients-repayment-plan. One study found that, as of 2010, 62% of borrowers in default were likely eligible for income-based repayment but had not enrolled, indicating that low take-up is an issue.24See page 62 of Looney and Yannelis (2015).

Besides low take-up, current income-based plans suffer from multiple design flaws that limit their ability to provide insurance to borrowers and maximize returns to taxpayers. First, and most importantly, they base repayment amounts on a borrower’s income from last year rather than current income. Second, while such programs contain forgiveness provisions that kick in if a borrower has outstanding debt at the end of some period of time (e.g., 25 years), any debt that is wiped out gets treated as taxable income.25See https://www.finaid.org/loans/ibr.phtml. In effect, the financial burden for the borrower shifts from student debt to tax debt.

One option would be to emulate the U.K. or Australia by restructuring all student loans from mortgage-style contracts to income-contingent loans.26For more details on the U.K. and Australian approaches, see Barr, Nicholas, Bruce Chapman, Lorraine Dearden, and Susan Dynarski, “The US College Loans System: Lessons from Australia and England,” 2019, Economics of Education Review, Vol. 71, pp. 32–48. In such a system, the government would set some minimum income threshold below which the borrower is not obligated to make any payments. Above that amount, employers would automatically deduct some fraction of a worker’s paycheck—as they already do for the payroll tax— which would be used to pay down student debt. Once the loan is repaid in full, such deductions would cease. In this arrangement, workers would automatically make smaller payments if their income declines or they enter a period of unemployment, and they would make larger payments if their income rises, thereby paying off the loan faster.

Besides setting the minimum income threshold, policymakers would also face other choices, such as setting the interest rate that applies to unpaid balances and the duration of repayment, after which point any remaining debt would be forgiven. A shorter repayment period would necessitate a higher repayment rate (i.e., higher fraction of income taken out of a worker’s paycheck), which, if too high, could reduce the incentive to work. The higher the minimum income threshold is, the more likely it is that a borrower ends up never repaying the entire loan and instead having it forgiven. While that might be desirable from the perspective of the borrower, it could prove quite expensive to taxpayers. Thus, policymakers would need to structure the program in a way that preserves its purpose as a source of insurance rather than an open-ended subsidy from taxpayers to borrowers.

Another related but somewhat different proposal would be to change the regulatory environment to pave the way for income-sharing agreements. Under such a system, employers could sponsor individual students by paying for their education in exchange for a claim to some fraction of the student’s income for some period of time. In principle, the financial terms of each income-sharing agreement could be individually tailored based on each student’s academic background, major, and college rather than being standardized by the government. This form of higher education financing would rely even more on market forces than the income-contingent system described above. However, its greater administrative complexity would preclude implementing it through the existing tax system.

Insurance against dropout risk

Given that a disproportionate share of defaulting borrowers failed to complete their degrees, another option is to institute automatic debt forgiveness in the event of dropout. According to one study, loan forgiveness in the event of involuntary dropout (i.e., failing out of school) could be provided at a low cost, even after taking into account the incentive that it could create for students to purposely fail out of school to have their debt erased.27See Chatterjee, Satyajit and Felicia Ionescu, “Insuring Student Loans Against the Financial Risk of Failing to Complete College,” 2012, Quantitative Economics, Vol. 3, pp. 393–420. However, expanding such dropout insurance to include voluntary cases (i.e., for students in good academic standing who leave of their own accord) would significantly raise the borrowing costs shouldered by successful students who do not drop out. To ensure that colleges have skin in the game, institutions could be charged a fee based on the volume of their students’ loans that are forgiven as a result of graduation failure.

Conclusions

Student debt is now the second-largest source of household debt after mortgages. However, the data dispute the narrative of student default being driven by borrowers with large balances. Instead, borrowers with larger balances are more likely to have graduate degrees (particularly in professional fields such as law or medicine) and higher incomes, which cause them to have lower default rates. Instead, default is most common among borrowers with the smallest balances, who are the least likely to have successfully completed a degree. They have debt obligations but not the higher earning potential to afford them.

Research shows that a more promising path than blanket loan forgiveness would be to make income-contingent repayment the norm and to couple it with some form of loan forgiveness in the event of college dropout. Together, these reforms would provide valuable insurance to borrowers, limit taxpayer exposure, and facilitate access to college.

It’s worth emphasizing that growing student debt is a symptom (and likely also a partial cause) of rising tuition. Broader higher education reforms that alleviate price pressures without sacrificing quality would naturally have a beneficial impact on America’s student debt problems.