1. Introduction

Initial research examining portfolios that mimic the stock holdings of US senators and members of the US House of Representatives show that these portfolios outperform the market by 10 percent and 6 percent, respectively (Ziobrowski et al. 2004, 2011). These results suggest that members of Congress may be privy to non-public information and could be benefitting financially from trading on an information advantage. Compared to the portfolios of other subsets of investors who trade on non-public information, stocks held by members of Congress perform remarkably well. For instance, Jeng, Metrick, and Zeckhauser (2003) show that the trades of actual insiders earn abnormal returns of about 50 to 60 basis points per month, or about 6 to 7 percent per year. Comparing the stock-picking performance of members of Congress to the performance of actual insiders provides some indication of the magnitude of the potential information advantage held by US lawmakers. In a more recent study, however, Eggers and Hainmeuller (2013) show that for a later time period (2004 to 2008), members of Congress do not appear to possess superior information, as trades from congressional members do not outperform the market. The conflicting results question whether or not members of Congress hold an informational advantage over the marginal investor.

Despite these confounding studies that challenge the informativeness of congressional stock trades, the perception that members of Congress may have been benefiting financially from trading on non-public information resulted in the introduction of the “Stop Trading on Congressional Knowledge” (STOCK) Act on January 26, 2012, by then-senator Joseph Lieberman. After several weeks of debate, the bill was signed into law on April 4, 2012. Approximately a year later, on Monday, April 15, 2013, the original STOCK Act was amended by Senate Bill 716. The bill quickly passed through both chambers of Congress (without debate) and was signed into law on Monday, April 15, 2013, by President Barack Obama. The primary change in the amendment relaxed the disclosure requirements of various employees and staffers of the US Congress. The disclosure requirements imposed on members of Congress or those running for Congress in 2012 remained in place.1The next section of the paper provides greater details about the STOCK Act generally and the amendment to the STOCK Act specifically. Given that the amendment passed quickly and without much publicity, the amendment provides a way to test how the market perceived the relaxation of rules restricting congressional trading on non-public information. That is, our study is not necessarily interested in determining the performance of portfolios that mimic congressional holdings. Instead, we are interested is examining the market’s perception to the potential information advantage that members of Congress might hold. The stock-price response, therefore, to the STOCK Act amendment can provide an important contribution to the existing literature by determining whether or not the market perceives that members of Congress have an informational advantage. There are several issues with the preceding research on this topic. For instance, the time period in Ziobrowski et al. (2004) ranges from 1993 to 1998 while the time period in Eggers and Hainmueller (2013) extends from 2004 to 2008. These short time windows do not allow for the robust time-series estimates that are required to determine portfolio performance in the traditional asset pricing tests.2Traditional empirical asset pricing tests examine monthly portfolios over periods as long as 30 years, which results in at least 360 observations used to estimate the time-series, multifactor models. The time periods analyzed in Ziobrowski et al. (2004) and Eggers and Hainmueller (2013) only examine five years of data. In contrast to the time-series tests found in other research, our tests examine the initial market reaction to the amendment of the STOCK Act in order to gauge market perceptions. Second, the two time periods cover markedly different economic periods. The latter half of the 1990s was a very strong bull market due to the run-up in stock prices of technology firms.3Ziobrowski et al. (2011) use data from 1986 to 2001. While substantially longer than previous studies, the time period extends through one of the largest bull markets in US history. On the other hand, by the end of 2008, the S&P 500 lost approximately 42 percent of its value relative to its high in October of 2007. At first glance, the performance of congressional stock holdings seems to follow general macroeconomic conditions. Examining stock prices surrounding the STOCK Act amendment allows us to make inferences about the market’s perception regarding the informational advantage of members of Congress.

The objective of this study is to examine the prices of stocks most frequently held in the portfolios of US representatives and senators during the period immediately surrounding the amendment of the STOCK Act. If insider trading laws are relaxed for those closely associated with members of Congress, then the market might perceive that those trading stocks most held by Congress have positive, non-public information. To the extent that the amendment of the STOCK Act provides a meaningful relaxation of insider trading laws, the market might view these changes as “good news” for the stocks most held by Congress, which would result in increasing stock prices. Stated differently, if portfolios that mimic congressional holdings indeed outperform the rest of the market, and if that outperformance is due to an informational advantage, as discussed in Ziobrowski et al. (2004, 2011), then any relaxation of insider trading laws for members of Congress (or their staffers) may increase the market perception that stocks most held by Congress will outperform in the future and stock prices will respond favorably. On the other hand, the prices of these stocks may decline during the period surrounding the amendment. For instance, a large literature discusses the advantages and disadvantages of insider trading laws. The benefits of insider trading may be that stock prices become more informationally efficient as new information becomes public more readily (Manne 1966; Leland 1992). However, a large literature discusses the disadvantages associated with insider trading. For instance, Ausubel (1990) suggests that the efficiency gains from allowing insider trading (i.e., more efficient stock prices) may be offset if uninformed investors reduce their investments in response to trading by insiders, thus reducing liquidity. In that vein, some studies directly show that markets are less liquid in the presence of insider trading (Copeland and Galai 1983; Kyle 1985; Glosten and Milgrom 1985; Leland 1992; Bhattacharya and Nicodano 2001). Other research shows that the likelihood of market manipulation is greater when insider-trading restrictions are not in place (Allen and Gale 1992; Benabou and Laroque 1992). To the extent that liquidity declines and manipulation increases, trading on non-public information may harm markets and subsequently reduce the prices of the stocks most affected by insider trading. Thus the market may recognize the greater risks associated with investing in stocks held by Congress, and the prices may fall during the period surrounding the STOCK Act’s amendment. We provide tests of these competing hypotheses.

Using standard event study techniques, we estimate cumulative abnormal returns (CARs) for various time windows surrounding the amendment to the STOCK Act. We use a number of different methods for calculating abnormal returns, which include residuals from daily market models and simple calculations of the difference between stock returns and various market benchmarks. Because we only have data on the holdings of members of Congress at the end of the year, we create two treatment samples of stocks. The first is the sample of stocks held most by Congress at the end of 2012 while the second consists of stocks that are most held by Congress at the end of 2013.4We recognize important limitations in our study. First, we do not have the list of stocks most held by Congress on the event day (the day the STOCK Act was amended). This is troublesome for at least two reasons. First, when the list of stocks most held by Congress is made publicly available (at the end of 2012), the market may respond to this new information, which possibly diminishes the stock-price response to the amendment itself. Second, using the 2013 treatment sample may have confounding effects as members of Congress may increase their holdings in stocks that responded to the amendment. Therefore, our sample may be biased. In addition, perhaps a cleaner way of conducting the analysis is to look at the profitability of specific stock trades by congressional members before and after the amendment. Unfortunately, the data on these stock trades is not widely available. For instance the Center for Responsive Politics only publishes the stock trades of the wealthiest 10 members of Congress. Perhaps a fruitful avenue for future research would be to conduct this type of analysis to better understand the profitably of stock trading by congressional members. Our study is left to identify the market’s perception of how a relaxation of insider trading laws influences the stock prices of those stocks most held by Congress. When examining the composition of those two samples, we find that 86 percent of the results from the two treatment samples are the same. For robustness, we replicate our analysis for both treatment samples.

In general, we find positive and significant CARs for various windows surrounding the amendment of the STOCK Act. In economic terms, we find that the three-day CAR surrounding the amendment is 0.81 percent or 0.92 percent depending on the treatment sample. In annual terms (if we extrapolate the threeday CARs to an annual level), these CARs indicate that the stocks most held by Congress outperformed the market by 68 percent to 77 percent, indicating that the results are not only statistically significant, but that they are also economically meaningful. We note that our results are significant only when we use the equal-weighted market index as the benchmark in our estimation of abnormal returns. We do not find that the CARs using the value-weighted market index are reliably different from zero.

We note that, coincidently, the day the STOCK Act was amended, the Boston Marathon bombing occurred. While our methods should account for market-wide shocks, we recognize the need to account for that potentially confounding event. Therefore, we examine several other time windows that cover the pre- and post-event periods. If our results are driven by the Boston Marathon bombing, then our findings should be primarily driven by days following April 15, 2013. We find strong evidence that, if anything, the positive CARs are driven by the pre-event period instead of the post-event period. In fact, when focusing on the alternative windows, we find significance for pre-event CARs using both the equalweighted and the value-weighted market index. Admittedly, the CARs using the value-weighted market index are notably smaller, but they remain statistically significant nevertheless. For instance, the CAR for the 10-day window prior to the amendment’s passage is approximately 2 percent when using the equalweighted market index, but only 0.9 percent when using the value-weighted index. In annual terms, those CARs represent an outperformance of the market by 50 percent and 23 percent, respectively.

To examine the possibility of other confounding events, we run two sets of placebo tests. First, we obtain 10 randomly selected event days and attempt to determine whether the positive CARs we observe in our previous tests are simply a function of our treated samples generally. After obtaining the 10 random event days, we estimate mean CARs for both the cross-sectional observations as well as the time-series observations. We replicate our analysis for both treatment samples and use both the equal-weighted and value-weighted market indexes as benchmarks. We do not find any positive and significant CARs in our placebo tests, suggesting that our results are not simply an artifact of our treated stocks outperforming the market generally across time.

In our second set of placebo tests, we draw two randomly selected samples of 50 stocks and replicate our analysis surrounding the STOCK Act amendment day. Again, we find that CARs generally are close to zero and are never significantly positive. The combined results from these two sets of tests suggest that the outperformance of our treated samples is related to the event since we do not find similar results for randomly selected stocks on the same day or the same stocks on randomly selected days.

In our final set of tests, we attempt to provide additional robustness to our results by estimating crosssectional regressions that control for a number of stock-specific characteristics, such as market capitalization, share prices, liquidity measures, and volatility. We then try to isolate whether the event CARs are indeed explained by the number of congressional investors. After scaling the number of total congressional investors by market cap, we find robust evidence that the CARs surrounding the event are higher for stocks with more congressional investors. These findings provide strong support for the idea that the prices of stocks most held by Congress significantly increase around the amendment of the STOCK Act. In another set of tests, we examine how the dollar amounts invested by members of Congress influence our event CARs. After scaling the dollar value of congressional holdings in a particular stock by the stock’s market cap, our regression results again find that event CARs are directly related to congressional trading.

The results reported in our study have important implications. First, instead of finding that stock prices decline, our results support the hypothesis that the prices of the stocks held most by Congress increase in response to the amendment. Our results thus contribute directly to the literature that examines the performance of stocks held by Congress (Ziobrowski et al. 2004, 2011; Eggers and Hainmeuller 2013), which heavily depends on the time periods analyzed. In this context, our findings support the idea that when the amendment was approved, investors perceived that those stocks most held by Congress would outperform the market in the future. Second, our findings speak indirectly to the literature regarding the effect of laws restricting trading on non-public information. While some studies document the efficiency benefits associated with insider trading, others seem to suggest that insider trading can result in market manipulation and a decline in liquidity. Finding that the prices of treated stocks increase surrounding the amendment suggests that the market does not view this particular type of insider trading negatively. Lastly, our findings also have implications for the broad literature that discusses the interaction between government and firms. Prior research shows that politically connected firms have lower tax liabilities (Richter et al. 2009), have access to better debt capital (Johnson and Mitton 2003; Chiu and Joh 2004; Cull and Xu 2005; Khwaja and Mian 2005), and enjoy other regulatory benefits (Morck et al. 2000; Yu and Yu 2010). Roberts (1990), Fisman (2001), and Faccio (2006) show that politically connected firms have higher valuations. Our findings—that the prices of the securities most held by Congress increase when some of the restrictions on insider trading are relaxed—seem to suggest that the market perceives the financial benefits of such connections.

The rest of the paper follows. Section 2 provides background on the STOCK Act and its amendment. Section 3 describes the data used throughout this analysis. Section 4 presents the results from the empirical tests. Section 5 offers some concluding remarks.

2. The Background of the Stock Act

Rule 37 of “The Senate Code of Official Conduct” states the following: “No Member, officer, or employee shall knowingly use his official position to introduce or aid the progress or passage of legislation, a principal purpose of which is to further only his pecuniary interest, only the pecuniary interest of his immediate family or only the pecuniary interest of a limited class of persons or enterprises, when he, or his immediate family, or enterprises controlled by them, are members of the affected class.” As part of Senate Resolution 110, a 1977 report, called “The Nelson Committee Report,” provided more details about potential conflicts of interest within the Senate by suggesting that, “Legislation may have a significant financial effect on a Senator because his holdings are involved, but if the legislation also has a broad, general impact on his state or the nation, the prohibitions of the paragraph would not apply.”55 The US Senate Ethics manual is available at the following website: https://www.ethics.senate.gov/public/index.cfm/publications. This potential loophole in the code may be the basis for the findings in Ziobrowski et al. (2004) showing that portfolios mimicking the holdings of US Senators outperform the market by nearly 10 percent per year.

On January 26, 2012, then-senator Joseph Lieberman introduced the STOCK Act as a way of effectively closing the loophole by restricting members of Congress and their staffers from benefiting financially by trading on non-public information. While the Securities and Exchange Act of 1934 and the well-known Rule 10b-5 restricted the trading of non-public information by corporate insiders, the final version of the STOCK Act, which was signed into law on April 4, 2012, extended those restrictions to members and employees of Congress. Among the other new restrictions, the STOCK Act also amended the Commodities Exchange Act, which prohibits certain transactions involving the trading of commodities based on privileged information, to apply to members and employees of Congress. Section 6 of the STOCK Act amended the 1978 Ethics in Government Act that requires specified government officials and employees to disclose securities transactions exceeding $1,000 within 30 to 45 days after receiving notice of the transaction.

After a few days of debate, the STOCK Act passed the Senate on February 2, 2012, and then the US House of Representatives on February 9, 2012. The Senate agreed (unanimously) to various House amendments to the original STOCK Act on March 22, 2012, before the bill was signed by President Barack Obama on April 4, 2012. Reports by media outlets suggest that nearly 30,000 senior government officials would be subject to the enhanced disclosure requirements.

An amendment to the STOCK Act was introduced late on Thursday, April 11, 2013; it passed the Senate—with unanimous consent and without debate—on Thursday, April 11, 2013. Likewise, the amendment made its way through the House on the afternoon of Friday April 12. The amendment’s main provision was to relax the enhanced disclosure requirements for any governmental employee other than (1) the President of the United States, (2) the Vice President, (3) any member of Congress, (4) any candidate running for Congress, and (5) any officer “occupying a position listed in section 5312 or section 5313 of title 5” of the US Code.6Both the STOCK Act and its amendment are available at https://www.congress.gov/bill/112th-congress/senate-bill/2038 and https://www.congress.gov/bill/113th-congress/senate-bill/716/text, respectively. Effectively, the amendment relaxed the disclosure requirements for tens of thousands of government employees who routinely have access to non-public information from which they could potentially profit.7We note that there is some confusion on whether the STOCK Act initially applied to family members of those in Congress. For instance, CNN identified a potential loophole that led to the confusion. See, for example, https://www.cnn.com/2012/07/19/politics/stock-act-loophole/index.html.

3. Data Description

The data used throughout the analysis come primarily from two sources. The first is the Center for Research on Security Prices (CRSP). The second is the Center for Responsive Politics (CRP). In particular, the CRP reports the 50 stocks held most by Congress at the end of each year. As mentioned above, we obtain two treatment samples: the 2012 (year-end) sample of stocks and the 2013 (year-end) sample of stocks. We choose to report our analysis for both treatment samples because some differences exist in the composition of those securities.

From CRSP, we obtain a number of stock-specific characteristics on the event day, which is the day the amendment was signed into law (April 15, 2013).8In a series of unreported tests, we analyze the stock-price response to those stocks most held by congressional members using April 11, 2013, as the event day, which is the day the amendment passed through both chambers of Congress. These findings are qualitatively similar to those reported below. In particular, the daily stock returns (as well as the market index returns) used to estimate CARs are obtained from CRSP. Table 1 reports statistics that summarize our two treatment samples. Total Inv is the number of members of Congress who hold a particular stock. Dem Inv is the number of Democrats in Congress who hold a particular stock while Rep Inv is the number of Republicans in Congress who hold a particular stock. Min Dem Inv is the average (minimum) reported amount held in a particular stock by Democrats in Congress. Min Rep Inv is the average (minimum) reported amount held in a particular stock by Republicans in Congress. Total Inv, Dem Inv, Rep Inv, Min Dem Inv, and Min Rep Inv are each obtained from the CRP.

Price is the closing share price on April 15, 2013, which is the day the STOCK Act was amended. Likewise, Size is the closing market capitalization on the event day. Turnover is the amount of share turnover (or the daily trading volume scaled by shares outstanding) on the event day. Volatility is the natural log of the intraday ask price minus the natural log of the intraday low price (Alizadeh et al. 2002). Price, Size, Turnover, and Volatility, are obtained from CRSP.

Table 1 reports results for the two treatment samples along with the data from CRP. We find that General Electric is the most held stock by members of Congress in both 2012 and 2013. We find some variation in the two samples. We note, however, that 43 of the 50 securities are the same across samples, suggesting that both samples are very similar. We also note that there seems to be a good deal of variation in the types of stocks that members of Congress hold. The stocks tend to be large, well-known firms. In fact, three of the top four mutual funds (based on assets under management) are index funds that track the S&P 500. Of all the securities in both of our treatment samples, only two are not in the S&P 500 (the SPDR Gold ETF and Vodafone). However, the stocks held by Congress typically are not the stocks most held by mutual funds and hedge funds. For instance, in 2016, Goldman Sachs conducted a historical analysis of “VIP” stocks or the stocks that are most held by mutual and hedge funds. Of the top 11 VIP stocks, only four are found in our treatment samples (Citigroup, EMC Corp, Google, and JP Morgan). We note that several of the treated companies are considered financial and others are retail stocks. However, a particular industry does not seem to be favored. The variation in the types of stocks held by members of Congress will be important in our analysis below.

Table 2 reports statistics that also summarize our sample. As seen in table 2, panel A, the average stock in our 2012 treatment sample has around 36 total Congressional investors, of which 15 are Democrats and 21 are Republican. We note that the minimum amount invested by Democrats is $495,000, while the minimum amount invested by Republicans is $1.2 million.9We note that the CRP states that members of Congress are not required to report the exact amount of holdings in each stock. Instead they are required to report only a range of values for each asset. The minimum amount invested is the minimum amount of the range held in each security. The average stock in our second treatment sample (panel B) differs only slightly. We note that the average stock in panel A has a share price of $3,225, although the distribution of price is heavily skewed given that the median price is only $56.25. The skewness in share price is driven by the fact that Berkshire Hathaway is included in both samples. The distribution in panel B is similar. The average stock has a market capitalization of about $130 billion, turnover of 6.5 to 11, and volatility ranging from 0.0236 to 0.0241.

4. Empirical Tests and Results

4.1 Event Study – Time Windows Surrounding the STOCK Act Amendment

We begin our analysis with a simple event study that examines the days around the passage of the STOCK Act amendment, which is reported in table 3. We report the cumulative abnormal returns (CARs) for securities held by members of Congress for various windows around the event day. April 15, 2013, is designated as day zero in our analysis. Negative numbers represent days prior to the event, and positive numbers represent days after the event. For instance, CARs for the time window (-1,1) include one day before the amendment, the event day, and one day after the amendment—or the three-day window surrounding the event. We also examine windows of (-2,2), (-3,3), (-5,5), and (-10,10), respectively. For robustness, we estimate abnormal returns in three different ways. First, we obtain residuals from a daily market model as a measure of abnormal returns, which is denoted as MM. Second, we take the difference between returns for a particular stock in our treatment sample and the market benchmark (MAR). Lastly, we estimate the daily market model but adjust the beta coefficient according to Scholes and Williams (1977) to account for non-synchronicity in the data. Each panel reports CARs for the three different estimates of abnormal returns. Panels A and B report the results for the 2012 treatment sample. Panels C and D report the results for the 2013 treatment sample. We note, however, that inferences regarding tests using the 2013 sample may be misguided. It is possible that members of Congress increased their holdings in particular stocks due to the stock-price response to the amendment, which occurred earlier in 2013. While we report the results for both treatment samples below, we raise caution and note the limitations of not having the construction of treated stocks on the day of the amendment. We also examine abnormal returns using both the equal-weighted and the value-weighted market portfolio benchmarks; the portfolios consist of the entire universe of stocks available on CRSP. We use the equal-weighted market portfolio in panels A and C and the value-weighted market portfolio in panels B and D. Below each CAR is the t-statistic, in parentheses, testing whether the CAR is significantly different from zero. Statistical significance levels are denoted using asterisks.

Column 1 of table 3 reports CARs for the (-1,1) window. CARs calculated using MM and MAR are both positive and statistically significant, with three-day returns of 0.0081 and 0.0108, respectively. Those CARs are significant at the 0.01 level and are also economically meaningful. For example, a three-day return of 0.0108 equates to about a 90 percent return if annualized (or extrapolated from the three-day CAR to the annual level). Although positive, CARs using Scholes-William’s (1977) (SW hereafter) methodology are significant only at the 10 percent level. A similar pattern can be found in columns 2 through 5. CARs for MM and MAR are positive and significant; CARs using SW generally are smaller and less significant, although still significant at the 0.05 level for the (-5,5) and (-10,10) event windows.

Panel C of table 3 reports results for the 2013 sample of stocks using an equal-weighted market index as a benchmark. Panel C is similar to panel A with all of the CARs positive and the majority of CARs statistically different from zero. CARs range from 0.0076 to 0.0181 using the MM benchmark and from 0.0104 to 0.0214 for CARs using the MAR methodology. The only CAR that is not significant at the 5 percent level is the SW for the (-3,3) window.

Panels B and D report the results using a value-weighted market index as the benchmark for the 2012 treatment sample and the 2013 treatment sample, respectively. While CARs using the value-weighted benchmark are consistently positive across both panels, they are not statistically significant. The lack of significance could stem from the fact that the treatment stocks are equally weighted when calculating CARs. We explore these issues below.

4.2 Event Study – Time Windows during the Pre- and Post-Event Periods

We next examine CARs for the different treatment samples across event windows that focus on the preand post-event periods independently. The purpose in doing so is twofold. First, as mentioned above, the amendment was signed into law on the same day as the Boston Marathon bombing. Our methods in calculating CARs should account for market-wide shocks unless our treatment samples are somehow systematically more prone to experience price movements in response to the bombing. Finding positive CARs instead of negative CARs for our sample does not seem to indicate that our treatment samples are contaminated. However, examining pre- and post-event windows may provide some additional insights into the likelihood that we are somehow picking up information for the bombing instead of for the amendment. Second, as seen in panels B and D of the previous table, we do not find significant CARs when using the value-weighted index. Examining pre- and post-event windows may allow us to make other inferences regarding these earlier results.

Table 4 is similar to table 3 in that panels A and B examine the 2012 sample, and panels C and D examine the 2013 sample, with the equal-weighted benchmark used in panels A and C and the valueweighted benchmark used in panels B and D. Table 4 is different in that columns 1 through 3 focus on pre-event windows (-10,-1), (-5,-1), and (-3,-1), respectively. Post-event windows, reported in columns 4 through 6, include (0,3), (0,5), and (0,10). An initial glance at table 4 illustrates that the positive and significant CARs surrounding the amendment primarily occur in the days leading up to the event day. This result is quite surprising given the circumstances underlying the amendment’s approval and the lack of publicity concerning the change. However, it is possible and perhaps plausible that the price movement during the pre-amendment period is likely due to a possible information leakage about the amendment to the STOCK Act. Column 1 of table 4 is uniformly positive and statistically significant, with CARs ranging from 0.0086 to 0.0220. In contrast to table 3, the pre-event CARs are statistically significant for both the equal-weighted and value-weighted market index benchmarks. We also see some significant CARs for the (-5,-1) and (-3,-1) windows in some of the specifications.10In other tests, we estimate CARs using multifactor models like in Fama and French (1993). These unreported tests allow us to draw conclusions that are qualitatively similar to those in table 4. In contrast, only 2 of the 36 CARs reported for the post-event windows are significantly different from zero.

4.3 Robustness – Placebo Event Study Tests

In this subsection, we report the results from several falsification tests to examine whether the previous results are spurious. We first examine the time component of our analysis. It could be that our sample of stocks held by members of Congress has outperformed the market over a much longer horizon than we test; examining returns around the amendment may merely be picking up that general trend. To rule out the possibility, we examine our two treatment samples around 10 randomly selected days that fall outside of our initial event window of 41 days (surrounding the actual amendment day). Said differently, we randomly select days for the two-year period (2012 and 2013) that fall outside the actual event window, and we replicate our analysis using these randomly selected event days. Table 5 reports CARs for windows around these randomly selected days. Those CARs are obtained first by averaging the CARs across the 10 randomly selected days for the stock in the treatment sample, and then by averaging the CARs over the cross-sectional observations. For brevity, we report only the CARs that are obtained from the daily market model (MM).11We note that similar results are found when we estimate CARs using MAR abnormal returns or SW abnormal returns. Furthermore, we report the CARs for pre- and post-event windows (windows surrounding our placebo event days), since the inferences we are able to draw in table 4 occur during the pre-event period.

Columns 1 and 2 report results for the 2012 sample of stocks, and columns 3 and 4 report results for the 2013 sample. In contrast to our previous findings where all of the CARs were positive, 15 of the 24 CARs from the placebo test are negative, with 6 CARs being significantly different from zero. It appears that the positive and significant CARs found around the amendment date are not part of a larger time trend.

Another possibility is that our results are capturing a broader market trend that is not specific to the securities in our sample. To alleviate those concerns, we implement another placebo test that randomly selects 50 firms that are not in our sample. We then estimate CARs around the initial event window associated with the STOCK Act amendment. As before, we report the results only for CARs obtained from a daily market model (MM), although we are able to draw similar inferences when we calculate abnormal returns using the MAR and SW methods. Table 6 reports the results from these placebo tests. Columns 1 and 2 report results for our first random sample, with the equal-weighted index benchmark in column 1 and the value-weighted index benchmark in column 2. Columns 3 and 4 detail results for a second random sample. Once again, the majority of CARs in this placebo test are negative but not significantly different from zero. The lack of positive and significant CARs in table 6 helps to alleviate concerns that our previous findings are not unique to the firms in our treatment sample.

The foregoing falsification tests, which do not yield a single positive and significant CAR, are helpful because they rule out possible alternative scenarios that could influence our results. In this case, it appears that our findings are unique to both the time period we examine and the firms that are owned by members of Congress. Randomly selected windows using our treated stocks or randomly selected stocks using our event window do not yield results similar to our previous tests.

4.4 Cross Sectional Regressions

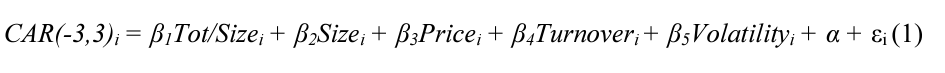

Another way to examine whether the prices of stocks most held by members of Congress are affected by the amendment of the STOCK Act is to estimate the association between event-window CARs and the level of congressional equity holdings in a multivariate framework. To do so, we estimate the following equation:

Here, the dependent variable is the CAR for the six-day period surrounding the amendment of the STOCK Act, CAR(-3,3). We choose this event window since it is the median event window used in the previous analysis.12We again are able to draw similar conclusions when using other event windows surrounding the amendment of the STOCK Act. The independent variables include the following: Tot/Size is the ratio of the total number of congressional investors scaled by market capitalization. Size is the market capitalization on the event day (in $billions). It is important to scale the number of members of Congress holding a particular stock by Size for at least two reasons. First, our univariate tests in tables 3 and 4 show that abnormal returns calculated using the value-weighted index produce markedly weaker results than when using the equal-weighted index. These results suggest the need to better provide controls for Size in our regression analysis. Second, Size captures (in part) the numbers of total shares outstanding. Stocks with more shares outstanding may have a higher likelihood of being held by members of Congress simply because there are more shares available.13Perhaps a more appropriate way to control for the possibility that shares outstanding affect the likelihood of congressional holdings is to scale by ownership breadth—or the number of shareholders instead of the number of shares outstanding. Our analysis simply assumes that ownership breadth and Size are very highly correlated. Scaling by Size provides an attempt to control for this possibility. Price is the event-day, closing share price (in $thousands). Turnover is the share turnover on the event day. Volatility is the natural log of the intraday high price minus the natural log of the intraday low price. We report the results from our cross-sectional analysis for the (-3,3) window in table 7. We estimate equation 1 for both the 2012 and 2013 samples, for both the equal-weighted and value-weighted benchmarks, and for each of the CAR methodologies (MM, MAR, and SW). We note that reported t-statistics are calculated using White (1980) robust standard errors. With respect to the control variables, we find that the coefficient on Size generally is negative and insignificant, while the estimate for Price generally is positive and insignificant. In the 2012 sample, Turnover produces a coefficient that is both negative and significant. However, the same is not true when examining the 2013 sample. We also find that the coefficient on Volatility is negative and generally insignificant. Focusing on the independent variable of interest, we find that the coefficient on Tot/Size is positive and significant in 10 of the 12 specifications. In economic terms, column 1 suggests that a one standard deviation increase in Tot/Size is associated with a 65 basis point increase in the dependent variable. This exercise suggests that the results in table 7 are not only statistically significant but also are economically meaningful.14In unreported tests, we replicate this analysis; but instead of examining the number of congressional members holding a particular stock, we partition the holdings by members of the Senate and members of the House. We again find positive and significant estimates, suggesting that the results hold whether we look at Senate holdings or House holdings. We note that while the coefficients on Tot/Size are positive in columns 8 and 11, the estimates are not reliably different from zero at the 0.10 level.

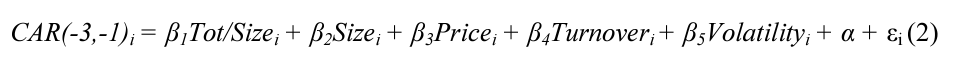

Next, we replicate our analysis in table 7 using the (-3,-1) event window. In particular, we estimate the following equation:

The only difference between equation 2 and equation 1 is that the dependent variable is measured over the pre-event time window. The other variables are the same as those in the first equation. As before, we report robust t-statistics below our coefficients, which are reported in table 8. Here, we again see that the coefficient on Tot/Size is positive in each specification and significantly different from zero in 10 of the 12 specifications. In column 1, the coefficient is 184.84 (t-statistic = 2.58), suggesting that a one standard deviation in Tot/Size equates to a 41 basis point increase in the pre-event CAR. In annual terms, the 41 basis point increase represents a 34.2 percent outperformance of the market benchmark. These results provide strong evidence for our univariate event study tests and suggest that the number of congressional investors influences event-period CARs in a meaningful way.

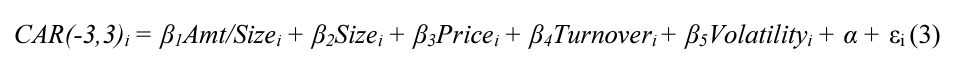

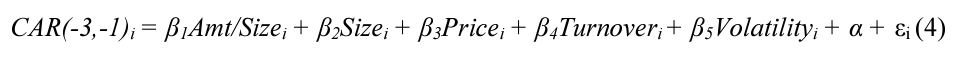

Next, we provide some additional robustness checks by examining the association between the estimated amount invested by members of Congress in each of our treatment stocks and the event-period CARs. In particular, we estimate the following two equations and then report the results in tables 9 and 10:

As before, we examine the seven-day period surrounding the amendment (CAR(-3,3)) in equation 3 and the three-day period prior to the amendment (CAR(-3,-1)) in equation 4. Instead of Tot/Size, the independent variable of interest is Amt/Size, which is the minimum amount invested by members of Congress in a particular security scaled by market cap. As mentioned previously, the CRP reports the minimum amount invested in a particular stock because members of Congress are required to report only a range of the amount invested. The minimum amount invested is the lower bound of that range and therefore underestimates the total amount invested in a treated stock.

Tables 9 and 10 are very similar to tables 7 and 8. In particular, the coefficient on Amt/Size in table 9 is positive in each of the 12 specifications but significant in only 10 of the 12 columns. In economic terms, a one standard deviation increase in Amt/Size results in a 65 basis point increase in CAR(-3,3) in column 1. These findings provide some evidence (similar to table 7) consistent with the idea that the amount of congressional investment in a particular security is associated with meaningful increases in the eventperiod CAR. We note that while the coefficients on Amt/Size are positive in columns 8 and 11, the coefficients are not quite significant at the 0.10 level.

Table 10 reports the results when we examine the pre-event CARs for the event window (-3,-1). Similar to table 8, the coefficient on Amt/Size is positive and significant across 10 of the 12 columns. The coefficients are not only statistically significant but are also similar in economic magnitude to the corresponding coefficients in the previous table.

Reviewing our cross-sectional regression results from tables 7 through 10, we consistently find a positive association between the stock holdings of members of Congress and CARs surrounding the amendment of the STOCK Act. As expected, the results are stronger for the pre-event window (-3,-1) than for the event-window surrounding the amendment (-3,3). Overall, our multivariate tests confirm our previous findings—namely that CARs for stocks held by members of Congress are larger around the amendment of the STOCK Act—and highlight the fact that the association between congressional ownership and event-day CARs is strong after controlling for a number of stock-specific characteristics.

5. Conclusion

The STOCK Act, which was introduced in January of 2012, was intended to restrict members of Congress and other government officials from trading on privileged, non-public information and benefitting financially from their positions in the public sector. After weeks of debate, the bill was signed into law in April 2012. Approximately one year later, the STOCK Act was amended in a curious manner: the amendment passed through both chambers of Congress without debate on a Friday afternoon and was signed into law by the president on the following Monday morning. The speed and lack of publicity associated with the passage of the amendment provides a nice framework to analyze how the market perceives a relaxation of restrictions on insider trading by government officials.

We examine the price of the 50 stocks most held by Congress surrounding the amendment of the STOCK Act. We find evidence that stock prices increase during the period surrounding the amendment. Interestingly, our results seem to be stronger when we examine the pre-event period rather than the postevent period. We conduct a series of placebo tests and determine that our results are not spurious. Multivariate tests show that, after controlling for a number of stock-specific characteristics, the number of congressional investors—or the amount invested by Congress—is directly associated with the event window CARs. Our multivariate tests seem to provide strong support for our univariate results reporting abnormally high CARs surrounding the amendment.

Our results have important implications as our findings distinguish between two different hypotheses. First, a broad literature suggests that the presence of insider trading can result in deteriorating liquidity and the possibility of market manipulation (Allen and Gale 1992; Benabou and Laroque 1992; Copeland and Galai 1983; Kyle 1985; Glosten and Milgrom 1985; Leland 1992; Bhattacharya and Nicodano 2001). If so, an amendment to the STOCK Act would adversely affect the prices of those stocks most held by Congress. Second, Ziobrowski et al. (2004, 2011) show that portfolios mimicking those held by members of Congress significantly outperform the market benchmark. In other words, stocks held by Congress may have already been outperforming the market when the amendment to the STOCK Act was passed. Our results support the second argument rather than the first. The findings in our study also have broad implications regarding the interaction between governments and firms. A stream of past research shows that politically connected firms have higher valuations (Roberts 1990; Fisman 2001; Faccio 2006), lower tax liabilities (Richter et al. 2009), have access to better debt capital (Johnson and Mitton 2003; Chiu and Joh 2004; Cull and Xu 2005; Khwaja and Mian 2005), and enjoy other regulatory benefits (Morck et al. 2000; Yu and Yu 2010). Our results seem to suggest that the market perceives the benefit of these connections as the prices of those securities most held by Congress increase when some of the restrictions on insider trading by government officials are relaxed.